- How do I receive payment for my translations?

For payment of the services provided, you must set up your preferred payment method on the platform (PayPal or Bank Transfer) and upload your invoices to your account on the Big Translation platform.

To issue an invoice, you need to have uploaded your collaboration contract to the platform, along with all documentation mentioned in it and any other documents required by the platform.

Once all documents have been uploaded, the option to submit your invoice will be enabled.

BigTranslation operates a monthly invoicing system, running from the 25th of one month to the 25th of the next.

Invoices must be uploaded to the platform between the 26th and the 28th of each month (inclusive).

The date on the invoice should be the 25th of the month in which it is being submitted.

If an invoice is uploaded outside this invoicing period, for example, on the 29th, it will be included in the payment batch for the following month.

BigTranslation will make the payment via bank transfer or PayPal between the fifth and tenth working day after the 28th of each month.

If you need any additional information regarding administrative matters, you can contact the Administration Department at [email protected]

- Do I have to invoice every month?

Yes, our translators must invoice monthly for the services provided during that month. You can see how much you have earned each month in the payment record on the platform. This amount cannot be carried over to subsequent months.

Amounts on the online platform that are not invoiced monthly, as a general rule and except in special cases, will not be paid to the translator.

The only exception applies to translators based outside the European Union, who must pay a commission for transfers. In this case, an amount of €50 can be accumulated on the platform before invoicing for services rendered.

Regardless, due to the nature of our system, an invoice must be submitted each month, even if the total amount is being accumulated.

- How are bank fees handled for transfers outside the European Union?

If the translator wishes to receive payment via transfer to an account located outside the European Union, any bank fees will be the responsibility of the translator.

- Is it necessary to be registered as self-employed to issue invoices?

Yes, you must be registered as self-employed to issue invoices, or be a company to issue invoices as a business. You must follow the tax regulations of the country where the translator is established in order to issue a valid invoice.

- What documentation do I need for invoicing?

We require documents proving that you are registered as self-employed and up to date with your tax and social security obligations, or the company’s fiscal documentation, depending on the legislation of the country where you are based.

For countries within the European Union, it’s usually possible to obtain a VIES or VAT number for invoicing within the EU. However, this varies depending on the country.

For countries outside the European Union, the corresponding documentation issued by the translator’s country of tax residence will be required.

If you have any doubts, we recommend checking with your accountant or financial advisor before signing the contract or starting any project.

- I’m not registered as self-employed. How can I invoice?

If you aren’t registered as self-employed, you shouldn’t be able to issue invoices.

The only exception is if you fall under a fiscal exemption. For example, if registration isn’t required under the laws of your country of tax residence. In this case, we will need a document or a copy of the regulation confirming that being registered as self-employed isn’t necessary in your country.

- What documentation do I need to invoice in this case?

If you don’t have a VIES or VAT number, or aren’t registered as self-employed because you don’t meet the minimum threshold in your country, or due to other legal provisions, we will need a document confirming that registration isn’t required under the legislation of that country.

If you have any doubts, we recommend checking with your accountant or financial advisor before signing the contract or starting any project.

- I haven’t received my payment. How can I check if everything is correct?

First, carefully review your invoice to ensure all relevant information is correct.

Amount, invoice date, invoice number, etc.

We will contact you via email if any changes or corrections are needed. Please keep in mind that we receive a large number of invoices each month, and an incorrect invoice could delay or even halt payments.

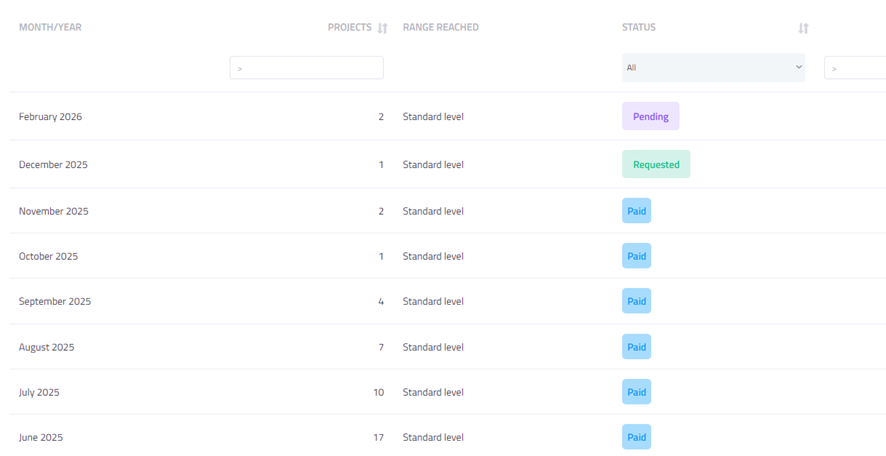

If your invoice is correct and everything is in order, go to the ‘Payments’ section on the platform and upload your invoice. If your payment status shows ‘Requested’, don’t worry! It means the Administration Department has received your invoice and will process it in the corresponding payment batch.

If we haven’t contacted you by email to request any corrections, this means everything is in order and your payment is being processed. However, it doesn’t necessarily mean that the funds have been sent yet.

For example:

Please remember that payment can take up to 10 working days after the invoicing period, and the transfer may take a few additional days to appear in your account.

Contact us only if the invoice shows as paid but you haven’t received the payment in your account by around the 20th of the following month.

We hope this information is helpful!